The stock market is a dynamic arena, filled with terms and concepts that can sometimes feel overwhelming, especially for beginners. Among these, “CE” and “PE” are two terms that often pop up when discussing options trading. Understanding what CE (Call Option) and PE (Put Option) mean in the stock market is crucial for anyone looking to navigate this space effectively.

1. What is CE in Stock Market?

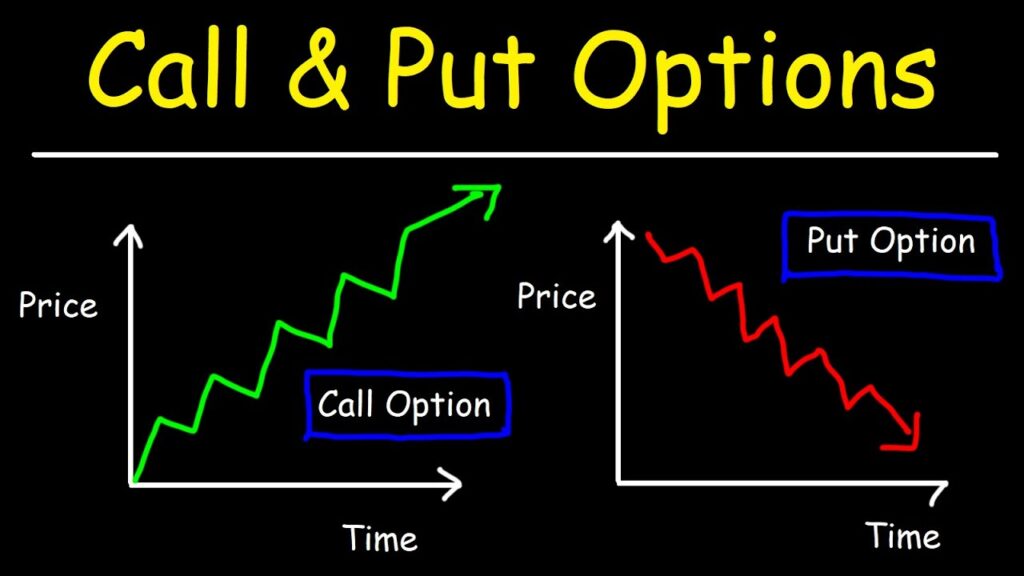

CE stands for Call Option, and it represents a financial contract that gives the buyer the right, but not the obligation, to purchase a specific amount of an underlying asset (like a stock) at a predetermined price (known as the strike price) within a specified period.

- How CE Works: When you buy a CE, you are essentially betting that the price of the underlying asset will rise above the strike price before the expiration date. If the asset’s price does indeed go up, you can either sell the CE for a profit or exercise your right to buy the asset at the lower strike price.

- Example of CE in Action: Suppose you purchase a CE for Stock XYZ with a strike price of $50. If the price of XYZ rises to $60 before the option expires, your CE becomes valuable. You can either sell the option for a profit or buy XYZ shares at the $50 strike price, which is lower than the current market price.

2. What is PE in the Stock Market?

PE stands for Put Option, which is the opposite of a Call Option. A PE gives the buyer the right, but not the obligation, to sell a specific amount of an underlying asset at a predetermined strike price within a certain time frame.

- How PE Works: Buying a PE is a strategy used when you believe the price of the underlying asset will decline. If the asset’s price drops below the strike price, the PE gains value, and you can either sell the option for a profit or sell the underlying asset at the higher strike price.

- Example of PE in Action: Imagine you buy a PE for Stock ABC with a strike price of $100. If the price of ABC drops to $80, your PE becomes valuable. You can sell the PE for a profit or sell ABC shares at the $100 strike price, which is higher than the current market price.

3. The Relationship Between CE and PE

CE and PE are two sides of the same coin in options trading. While CE is used when you expect the asset’s price to rise, PE is used when you expect it to fall. Traders often use a combination of CE and PE strategies to hedge their positions and minimize risk.

- CE and PE in the Context of Market Sentiment: The prices of CE and PE options are influenced by market sentiment, volatility, and time decay. For instance, in a bullish market, CE options tend to be more expensive due to the higher probability of price appreciation. Conversely, in a bearish market, PE options are more in demand.

4. Why Understanding CE and PE is Crucial for Traders

Understanding CE and PE is essential for anyone looking to engage in options trading. These instruments allow for a wide range of trading strategies, from hedging existing positions to speculating on market movements. By mastering the concepts of CE and PE, traders can enhance their ability to make informed decisions, manage risk, and potentially increase profitability.

5. Key Considerations When Trading CE and PE

- Time Decay: As options approach their expiration date, their value gradually diminishes. This phenomenon, known as time decay, is a critical factor to consider when trading CE and PE.

- Volatility: Fluctuations in the market can greatly influence the pricing of options. Higher volatility typically increases the value of both CE and PE options.

- Strike Price Selection: Choosing the right strike price is vital for the success of an options trade. It requires a careful analysis of the underlying asset’s price movement and market conditions.

6. Conclusion

CE (Call Option) and PE (Put Option) are powerful tools in the stock market that offer traders flexibility and opportunities to profit in various market conditions. Whether you’re bullish or bearish on an asset, understanding how to leverage CE and PE can make a significant difference in your trading strategy. By grasping these concepts, you’ll be better equipped to navigate the complexities of the stock market and make informed decisions that align with your financial goals.